Wax On, Wax Off

One of my all-time favorite films was the 1984 version of The Karate Kid. In

Company investors, board members, senior executive leaders, and the media routinely ignore an insight best captured in General and President Dwight Eisenhower’s quote: “In preparing for battle, I have always found that plans are useless, but planning is indispensable.”

Competition in business markets, like wars, have many unanticipated twists and turns. A single fixed “strategic plan” has to be frequently changed to adapt to external conditions.

Every firm must start with a “credible” draft plan which affirmatively answers the following questions:

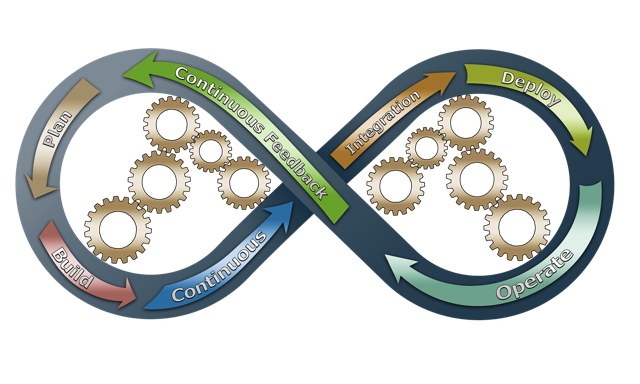

However, after that, success comes from testing out the plan’s underlying assumptions, learning broadly from each step, adapting rapidly, and scaling up only when there is a high degree of confidence that the plan retains credibility.

Too many investors and Board members require CEOs to prepare a single, comprehensive, falsely precise “strategic plan” that is expected to guide decisions for an extended period of time. The alternative approach, that a plan is a living document that changes frequently and adapts to new market data and is less precise and certain, frightens both less innovative Board members and even many investors.

Eric Reis takes this analysis a step further in The Lean Start-up. He states that every market encounter should yield “validated learning” that either reinforces, modifies or transforms the plan. Other principles follow along with what this kind of planning process entails:

On multiple occasions, small data signals helped Pitney Bowes understand big market opportunities or trends. The first trend was a gradual movement away from businesses handling small direct mailing in their mailrooms to outsourcing that mail to local print shops.

I was alerted to that by receiving an invitation to a Manhattan Institute event. The Institute had a Pitney Bowes postage meter in its mailroom, but the Manhattan Institute had outsourced a 500-piece mailing, because the print shop had acquired technology and operated under new postal discount rates that made outsourcing more economical. The postage meter imprint was that of a competitor with a stronger position in direct mail print shops.

We had stayed out of the direct mail/print shop market because it seemed to be too small and unprofitable, but this experience caused us to re-examine our assumptions, invest in direct mail technology and in presort mail services, and win the market away from a competitor. Outsourced bulk marketing mail now far outstrips mail processed in in-house mailrooms.

The second small data signal was one that led to us getting into the revolving credit business. My leasing team told me that the business was too small and unprofitable.

However, Lisa DeBois, who had new business development for financial services among her responsibilities, dissented. She observed that many mailroom customers, even in big companies, requested end-of-the-month cash advances to acquire postage for mailings. We made a few million dollars on cash advance fees, but no one thought this was a big market.

Lisa proposed that we charge credit card interest rates. What she intuitively understood was that mailrooms were willing to pay a short-term interest penalty to get invoices and direct mail solicitations mailed on time. A 1-2 day delay in outbound mailings would cost them far more than the incremental credit interest charges. We created a highly profitable $200 million business before I retired.

Some leaders look at “bellwether” customers or thought leaders to figure out where their market is going. Others look at seemingly small, unimportant metrics to discern a market trend. Still others look at whether talent is attracted to or leaving a business.

Great leaders connect more dots than people below them, and look for signals and data that may escape others. When Pitney Bowes was trying to figure out what predicted cancellation or retention of postage meters after a 90-day free trial, Al Briggs, our Customer Care VP, told me that many meters came back in unopened boxes. The best predictor of retention was whether customers opened the box shortly after receiving it. We hired outbound tele-sales operators to guide them through that process.

“Small data” can come to CEOs from anywhere. More senior people often present the “big picture” to their CEOs. They often omit small data that, to the CEO, might be highly insightful.

Many senior executives make the mistake of focusing solely on aggregate data. They ignore the “outlier” data that often yields additional insights. When I ran HR at Pitney Bowes, the Benefits management team presented aggregate healthcare cost data from our company and other Fortune 500 firms. That aggregated data showed that average healthcare cost increases for self-insured plans and for Medicare were in the 12-14% per year range.

However, a mid-management Benefits manager gave me an audiotape of a lecture by Dr. John Wennberg at Dartmouth, who studied high and low healthcare spending outliers in regions around the country. The spending on specific medical conditions ranged by a factor of 5 to1. Wennberg’s research demonstrated that low-spend areas did three things right, which the high spend areas and we were not doing:

We incorporated all these principles into both health plan design and the delivery of healthcare, produced far lower cost increases and improved health and healthcare quality and access over the next 18 years. The mid-manager and that audiotape gave me insights I would not otherwise have gotten.

I implemented another practice to get more “small data” insights: “skip-level” meetings with people not reporting directly to me. I learned more talking with them than I could ever have imagined.

Great CEOs follow these practices in ways that work in their organizations. Why do the rest not do so?

As the CEO of the Dossia Service Corporation and an advocate for more innovative employer-sponsored health programs, I tried to get CEOs to focus on health and safety because of the huge financial and business benefit.

Many thought it was beneath them. They usually told me that I should work with their HR and Benefits “business partners,” who were outsourcing their decision processes to benefits consultants and 3rd party administrators.

One superstar, Rick Barry, a contemporary of Chamberlain’s, threw underhanded free throws and had one of the highest lifetime success rates, but no one copied him. When I watch many CEOs avoid obviously good steps through the effective use of small data and better connection to front-line employees, I feel like I am watching a re-run of the Chamberlain story.

Historically, we have accepted the apparent inevitability that a certain percentage of businesses will fail, a very low percentage of start-ups will succeed and that business decision processes should proceed on the basis of large data sets collected after an extended period of time to feed annual, fixed strategic plans.

All that has to change. Both current and future leaders need to adapt the way they plan and decide on actions and to be comfortable with adapting quickly and with less-than-complete data on plans and strategies. That will not be easy, but it is the lowest risk approach to decision making.